Thanks for stopping by our old FSAstore.com blog. We’ve moved!

Follow the latest FSA news via FSAstore.com/blog.

Thanks for stopping by our old FSAstore.com blog. We’ve moved!

Follow the latest FSA news via FSAstore.com/blog.

Our second partner spotlight focuses on 24HourFlex. 24HourFlex and its parent company, RPS Plan Administrators, have been providing employee benefit solutions for more than 25 years. They specialize in employee benefit administration including Flexible Spending Accounts (FSAs) Health Reimbursement Accounts (HRAs), Health Savings Accounts (HSAs), Parking and Transportation Plans, Retiree Billing and COBRA administration.

Our second partner spotlight focuses on 24HourFlex. 24HourFlex and its parent company, RPS Plan Administrators, have been providing employee benefit solutions for more than 25 years. They specialize in employee benefit administration including Flexible Spending Accounts (FSAs) Health Reimbursement Accounts (HRAs), Health Savings Accounts (HSAs), Parking and Transportation Plans, Retiree Billing and COBRA administration.

24HourFlex has partnered with FSAstore.com for more than two years. Customer service is at the very core of its operations.

“We’re smaller [than some of the FSA providers], so we have an ability to be agile and create more customized solutions for customers. We really take care of our customers, whether on the phone or over email, and that’s what customers really like about us,” explained Jim Hayes, operations manager at 24HourFlex.

Not only does 24HourFlex provide thorough customer service, but it also prepares participants for health care reform through newsletters and email updates. “We work directly with brokers and employers on how changes impact their business,” added Hayes.

Thinking ahead about health reform, Hayes noted, “FSA and HSA participation will increase as individuals gain more awareness around health insurance and seek ways to reduce the cost they have to pay.”

Hayes further said that FSAstore.com offers an easy-to-navigate platform for 24HourFlex participants. “Participants can easily find and browse items, and the site makes it very clear what is eligible with a prescription or without. We have participants in remote areas [blue collar factory workers] who don’t have pharmacies within reach where they can purchase items,” Hayes said. “For them, it’s easy to use their 24HourFlex card, shop at FSAstore.com, and have their items shipped.”

He added, “People don’t want to shop in-person, they want to shop online. FSAstore.com handles things in a customer friendly way that matches our philosophy of customer service as well.”

Most important to 24HourFlex participants are the products available through FSAstore.com and the customer service provided, according to Hayes. Participants directly approach 24HourFlex with any educational questions about their FSAs including FSA eligibility, the inner workings of an FSA, what happens to unused funds, and election changes.

When it comes to simplifying product eligibility, Hayes noted his support of SIGIS adoption as a way to unify transaction processing across the industry. Stores implementing IIAS systems would benefit TPAs “as more customers would be able to use their cards instead of submitting manual claims,” he added.

An industry-wide educational component to eliminate confusion about FSAs and HSAs would help participants as well.

“Education around benefits is difficult as employees have busy lives and are overwhelmed with information. Education can be improved by working with Human Resource and Benefit teams to provide clear communication around these types of plans to employees,” Hayes said.

Many thanks to 24HourFlex for sharing their partnership experience with us! Check out 24HourFlex on Twitter, Facebook and YouTube. Visit http://www.24hourflex.com.

Do you want to be featured in a spotlight? Let us know!

“Be ready!” That’s the motto for September’s National Preparedness Month.

In its tenth year now, National Preparedness Month highlights emergency preparedness across the country. The Federal Emergency Management Agency in the U.S. Department of Homeland Security sponsors the month each year.

Today marks the 12th anniversary of the September 11 attacks – an important time to honor those who passed and those who risked their lives to save others.

What do you need to do to get ready? And how does your Flexible Spending Account help?

1. Get a first aid kit. If you already have a first aid kit, make sure to replenish it. As fall approaches, it brings severe weather in some regions. If you don’t have a first aid kit, you should know these are covered by your FSA. An all-purpose first aid kit will include bandages for wound treatment and protection, and other solutions against aches and burns. Check out FSAstore.com’s FSA eligible First Aid section to update your first aid supplies.

2. Grab first aid items for kids. If you have children, get their favorite cartoons in band-aid form. A themed kids hot and cold pack might make pain a little less difficult to deal with. We have a selection of children’s first aid products that are eligible with your FSA.

3. Create an emergency plan. Talk to family members about what you will do in case of an emergency (where you’ll go in case you are not together, how you will get in touch, and what you will bring). It may not seem necessary, but it never hurts to be prepared.

4. Stay informed through news updates. Have a radio and extra batteries handy to learn about open shelters and possible evacuations. The media might also give you tips on how to safe.

FSA Q&A: Are Diabetic supplies eligible with a Flexible Spending Account?

Yes. Diabetic supplies qualify as medical expenses covered by a Flexible Spending Account. For instance, a blood sugar test kit and test strips would be covered as an FSA eligible expense.

FSAstore.com offers a variety of blood glucose testing supplies, insulin, diabetes nutritionals and more to monitor and treat diabetes. Though some FSA eligible products require a prescription for FSA reimbursement, insulin is excluded from the prescription requirement.

FSAstore.com offers a variety of blood glucose testing supplies, insulin, diabetes nutritionals and more to monitor and treat diabetes. Though some FSA eligible products require a prescription for FSA reimbursement, insulin is excluded from the prescription requirement.

FSAstore.com offers a Diabetes bundle (left) and additional products under FSA eligible Diabetes Care.

Services

A visit with an endocrinologist regarding Diabetes is covered with an FSA as well. Find a local endocrinologist through FSAstore.com FSA Eligible Services.

Diabetes Health Chat

The NYC Health Commissioner & Dr. Sanjay Gupta have discussed the prevalence of Diabetes, symptoms and prevention on Twitter.

Diabetes statistics, facts & tips:

![]()

![]()

![]()

![]()

October 1 is an important day for health reform: it’s the beginning of open enrollment for the Health Insurance Marketplace. The Health Insurance Marketplace promises to offer easier and more affordable insurance options for Americans. According to the Department of Health and Human Services, it will allow consumers to shop for insurance by comparing health plans that fit their needs. On HealthCare.gov you’ll be able to search for insurance options – whether personalized coverage (for you or your family) or small business coverage

What about my Flexible Spending Account (FSA)?

If you have an FSA, you might be concerned about how health care reform could affect your plan. Below is a small timeline of coverage changes that have occured so far to keep you in the loop.

Health Reform & FSA Timeline

2011:

Since January 1, 2011, over-the-counter medications have required a prescription to be eligible for reimbursement under a Flexible Spending Account, Health Savings Account or Health Reimbursement Account. Insulin is an exception to this prescription rule.

January 1, 2013:

Important to Know

Additional information

Employers can find details about compliance with the new limit via IRS Bulletin 2012-40.

The U.S. Department of Health and Human Services shows how health reform affects your state (in terms of insurance options) here.

Debilitating, throbbing head pain. Sensitivity to light and sound. Inability to focus or work.

These are just a few migraine symptoms. We recently joined a Twitter #MigraineChat hosted by Time, Inc. and Mayo Clinic. We learned about treatment options, types of headaches and migraine triggers.

Mayo Clinic has a self-assessment tool through which you can check if your headache symptoms are migraine-like.

FSA: Migraine Care

You can use your Flexible Spending Account toward migraine treatment in three ways:

1. FSA Eligible Products. Buy 100% eligible products such as cooling gel sheets for relief. Get pain relievers such as Advil Migraine or Excedrin Migraine which require a prescription. View FSAstore.com’s selection of FSA eligible products for migraines.

2. Visit various health care providers for migraine treatment. Use an FSA for copays, coinsurance or deductibles.

We asked a Mayo Clinic neurologist for feedback:

![]()

Health providers for migraine treatment:

– Primary care provider – if you’re experiencing unusual and severe headaches, a visit to the primary care provider is in order. The doctor may refer you to a specialist such as a neurologist for further examination. Find an FSA Eligible Neurologist via FSAstore.com.

– Alternative medicines might also alleviate migraine pains. An FSA can be used for visits with chiropractors and acupuncturists, whose services are typically not covered by regular insurance.

– Migraines could be caused by vision problems as well. Optometrists are FSA eligible service providers. Search for an optometrist via FSAstore.com FSA Eligible Services.

More Twitter health tips follow below:

![]()

![]()

![]()

![]()

![]()

![]()

![]()

While many medical services are FSA eligible, not everything is covered by a Flexible Spending Account. IRS publication 502 outlines exactly which services are FSA eligible.

If you have any doubts about FSA coverage for products or services, contact your FSA administrator about the details of your FSA plan, or check the Summary Plan Description for information.

Medical Necessity

Services must always be medically necessary to qualify for FSA reimbursement. For instance, services provided by a dentist are FSA eligible as long as they include routine exams, fillings, and other medical procedures.

Questions often come up about specific medical expenses. Check out the examples below to get an idea of popularly asked about services.

Not eligible

Teeth whitening. Since it’s a cosmetic procedure, you would not be able to use your FSA to cover costs.

Funeral costs. You would not be able to pay for funeral costs with your FSA.

Maternity clothes. While baby care items such as breast pumps, overnight underpants, and baby thermometers are FSA eligible, maternity clothes are not covered by an FSA.

Possibly covered (depending on medical need)

Fees paid to a gym. Gym membership for recreational purposes is not covered by an FSA. Gyms can be considered FSA eligible if particular exercise is recommended by a doctor and prescribed through a Letter of Medical Necessity.

Cosmetic surgery. Since cosmetic surgery is intended to improve someone’s appearance without treating a disease or being medically necessary, it does not qualify for FSA reimbursement. However, cosmetic surgery would be allowed if it is medically necessary resulting from a personal injury or related to a disfiguring disease or congenital abnormality.

Search for nearby FSA Eligible Services at FSAstore.com!

Health Savings Accounts (HSA). Flexible Spending Accounts (FSA). What’s the difference?

Apparently, according to a recent survey by Fidelity Investments, it’s unclear.

When asked about the FSA, 73% of survey respondents often confused it with an HSA – thinking it was the same type of plan. The majority of respondents (69%) were convinced that the HSA and FSA have the same “use it or lose it” provision – meaning their funds would expire if they were not used by set deadlines.

Here are the most important details for each plan:

Both plans offer major tax savings for participants when health care costs are on the rise. Flexible Spending Accounts are not subject to federal (and often state and local) income taxes, or social security and Medicare taxes. Health Savings Accounts can also not be subject to federal income taxes or Social Security & Medicare taxes if the employee HSA contributions are made through a cafeteria plan. If they are not, the employee only saves state and federal taxes.

FSA

What are they? Employee benefit add-on that lets people set aside pre-tax money on eligible medical expenses.

What’s covered? Applicable medical expenses include over-the-counter products, prescriptions, and co-pays, coinsurance and deductibles for visits with health care providers.

What are contribution limits? $2,500 per person per year; $5,000 per family is both spouses have an FSA.

Other important details?

HSA

HSAs have been growing in popularity. In 2012, some 8.2 million Americans had HSAs, Fidelity Investment pointed out.

What they are? A Health Savings Account is a tax-free trust or custodial account for those who are enrolled in a high-deductible health insurance plan.

What’s covered? Qualified medical expenses similar to the FSA. To get a detailed, IRS-approved list, go here.

What are the contribution limits? As of 2013: $3,250 for a single person, $6,450 per family. As of 2014: $3,300 for a single person, $6,550 per family.

Other details?

Funds roll over year-to-year (funds are not “use it or lose it”). You can keep contributing to an HSA at any time. Your HSA also comes with you as you leave your job.

More Education

The Fidelity survey highlights a pressing need for education about employee benefits. Where does the gap start in understanding these plans? Employees often turn to their HR departments for answers about any work-related issues, and employee benefits should be one of those as well.

As open enrollment approaches for many companies, it’s a good time to start researching options available. Are you unsure what an FSA or HSA is? How do these plans benefit you? Does your company offer either of these plans? Do you realize the tax savings you could get from an FSA?

How FSAstore.com Helps

FSAstore.com offers many different tools to help you sort out your FSA needs.

As kids return to school, it’s good to consider several routine medical exams to ensure they’re healthy as can be. Among these should be an annual vision exam since kids will be reading extensively, spending hours using computers for assignments, and taking notes from the chalkboard.

August is Children’s Eye Health and Safety Month. Monitoring vision should start as early as right after birth. A vision exam will help with detecting potential (severe) eye problems in years ahead.

Flexible Spending Accounts & Back to School

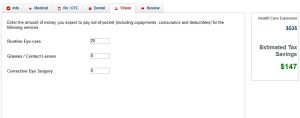

A Flexible Spending Account covers vision care. As you’re calculating contributions for open enrollment, think about your family’s health needs for the year. Routine eye care (vision exams and testing for glaucoma) out-of-pocket expenses such as co-payments, coinsurance and deductibles can be paid for using an FSA. Additionally, the FSA will cover the cost of glasses or contact lenses, and if necessary, even corrective eye surgery including LASIK.

If you’re thinking about your kids, then your FSA can be applied during visits to a pediatrician for vision screenings, and later for an optometrist or ophthalmologist if further exams are necessary. Search for locally-available pediatricians or ophthalmologists using FSAstore.com’s FSA Eligible Services.

According to the American Optometric Association, routine vision screenings should be performed at 6 months old, 3 years and 5 years old. Yearly vision exams are necessary since vision can change over time. Poor vision can impact performance in school as it’s more difficult to comprehend reading materials or concentrate in class.

Vision concerns

If a child reports the following symptoms (or other more severe ones), it’s time to schedule an eye exam with the pediatrician:

It’s open enrollment season. Each year, this period of time lets you change or select new benefits at work. Flexible Spending Accounts are part of the open enrollment if your company offers them. These accounts let you save pre-tax money for qualified expenses. You have to opt into an FSA each year since enrollment is voluntary. Contributions for the FSA are limited to $2,500 per year (per person) for 2013.

Calculate expenses in a few minutes before you enroll to maximize your FSA benefits.

It’s easy with our FSA savings calculator!

An FSA savings example:

Step 1: Plug in personal information (income, marital status and state). FSAstore.com does not store this private information anywhere!

Step 1: Plug in personal information (income, marital status and state). FSAstore.com does not store this private information anywhere!

Step 2: Calculate medical expenses such as routine office visits, specialist office visits, expected surgery and chiropractic care.

Step 2: Calculate medical expenses such as routine office visits, specialist office visits, expected surgery and chiropractic care.

Step 3: Estimate expenses for over-the-counter medications, prescriptions, and medical supplies. *Many FSA products are eligible without a prescription, but anything containing medicine requires a prescription for FSA reimbursement.

Step 4: Calculate dental care costs. Out-of-pocket costs (co-pays, deductibles) for cleanings, x-rays and fluoride treatments are FSA eligible. Braces can be FSA eligible, but it depends on your individual FSA plan if that expense is covered.

Step 4: Calculate dental care costs. Out-of-pocket costs (co-pays, deductibles) for cleanings, x-rays and fluoride treatments are FSA eligible. Braces can be FSA eligible, but it depends on your individual FSA plan if that expense is covered.

Step 5: Vision care is FSA eligible. Figure out which out-of-pocket expenses you’ll need covered whether for an eye exam, glaucoma testing, glasses or contacts or even LASIK.

Step 5: Vision care is FSA eligible. Figure out which out-of-pocket expenses you’ll need covered whether for an eye exam, glaucoma testing, glasses or contacts or even LASIK.

Step 6: Get an overview of all of the final expenses and see your estimated tax savings immediately.

Step 6: Get an overview of all of the final expenses and see your estimated tax savings immediately.

IMPORTANT FSA TIPS: Your employer sets limits on your maximum annual contribution, so check in before making a final contribution. Carefully plan your FSA contribution. Unused FSA funds are forfeited at the end of plan year or grace period.